Bankruptcy court orders liquidation of Mehul Choksi-promoted Gitanjali Gems

Synopsis

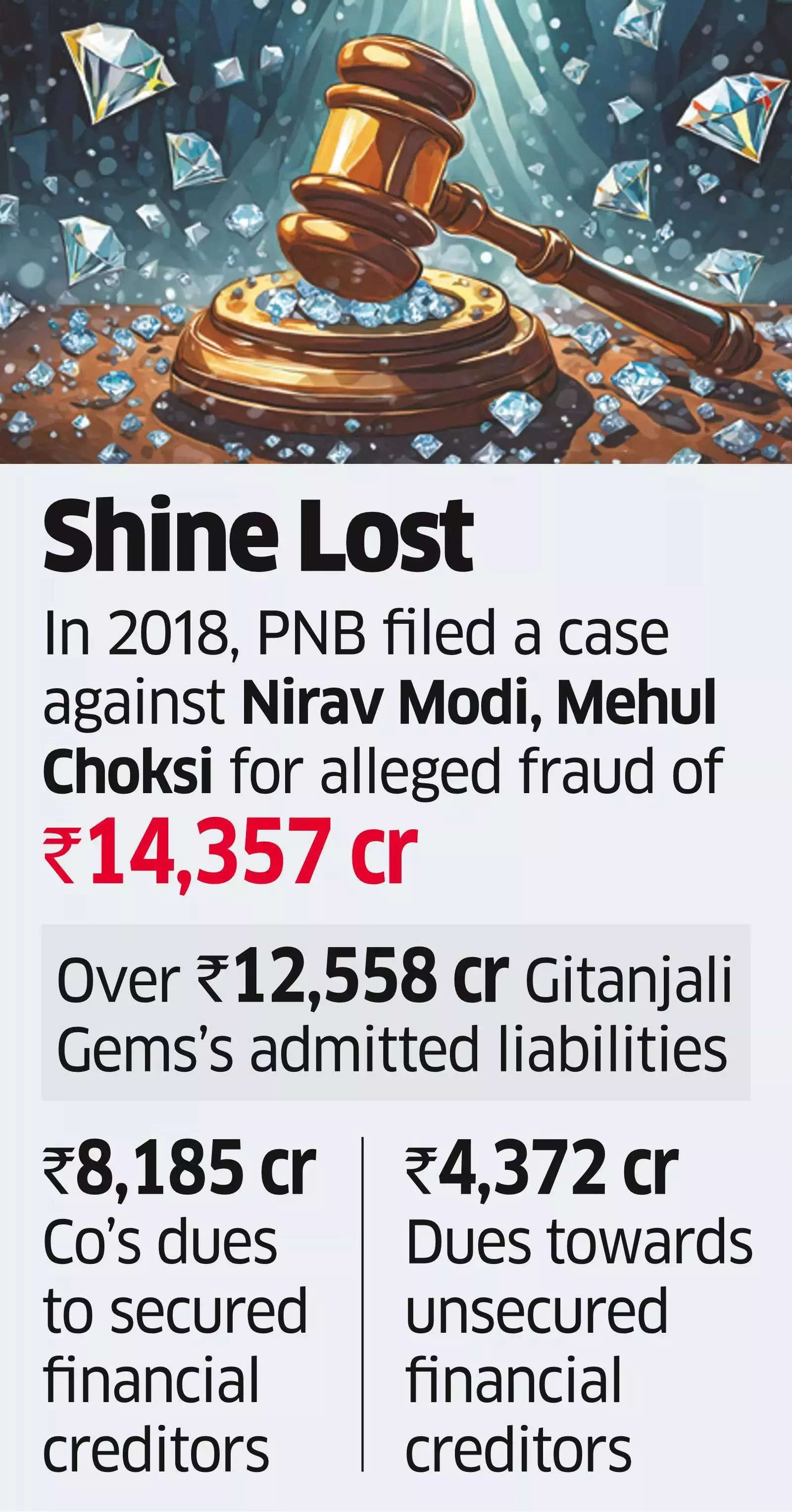

The company was originally admitted under the Corporate Insolvency Resolution Process (CIRP) in October 2018. It has admitted liabilities of over Rs 12,558 crore.

"The Mumbai bench of the National Company Law Tribunal has ordered the liquidation of fugitive diamantaire Mehul Choksi-promoted firm Gitanjali Gems. The tribunal has also appointed Santanu T Ray as the liquidator.

The company was originally admitted under the Corporate Insolvency Resolution Process (CIRP) in October 2018. It has admitted liabilities of over Rs 12,558 crore.

“The CoC (committee of creditors) with requisite voting… has approved the liquidation of the corporate debtor in view of bleak chances of receiving any resolution plan,” the division bench of judicial member Kuldip Kumar Kareer and technical member Anil Raj Chellan said in its order of February 7. “This tribunal has very limited powers of judicial review in such matters of commercial wisdom.”

This is the second Mehul Choksi-promoted company to be admitted under liquidation. In July 2021, the tribunal ordered the liquidation of Nakshatra World, a subsidiary of Gitanjali Gems.

Before the order, the company’s resolution professional (RP) Vijay Kumar Garg had informed the tribunal that on account of the alleged fraud perpetrated by the company and its officers, its affairs are subject to probe by multiple law enforcement agencies such as the Central Bureau of Investigation and the Enforcement Directorate.

The RP had argued that upon his appointment, he wrote to various investigating agencies seeking details and access to properties, assets, stocks and records of the company to proceed further with the CIRP. However, the agencies rejected the request and refused to lift the attachment over the corporate debtor’s properties.

Since the assets of the company were under attachment by the ED and considering the bleak chances of insolvency resolution amid the ongoing investigation, the lenders had decided to liquidate the company with 90.16% voting in favour.

Originally, the company was admitted under the CIRP following an application filed by ICICI Bank through counsel Rohit Gupta after the company defaulted on its dues of about Rs 608 crore.

“This is particularly a sui generis case where ... "

https://economictimes.indiatimes.com/in ... 9&from=mdr&