Gold demand to hit record with central bank buying, WGC says

Bloomberg News | January 31, 2024 | 10:10 am Intelligence Asia China Europe Russia and Central Asia USA Gold

In China, demand for gold jewelery is likely to remain stable. Credit: Chow Tai Fook Jewellery

"Total gold demand hit a record last year and is expected to expand again in 2024 as the US Federal Reserve moves toward cutting interest rates, potentially aiding prices, according to the World Gold Council.

Overall consumption climbed by about 3% to 4,899 tons last year, supported by strong demand in the opaque over-the-counter market, as well as from sustained central-bank buying, according to the WGC’s full-year report. That’s the highest total figure in data going back to 2010.

Sign Up for the Precious Metals Digest

Sign Up

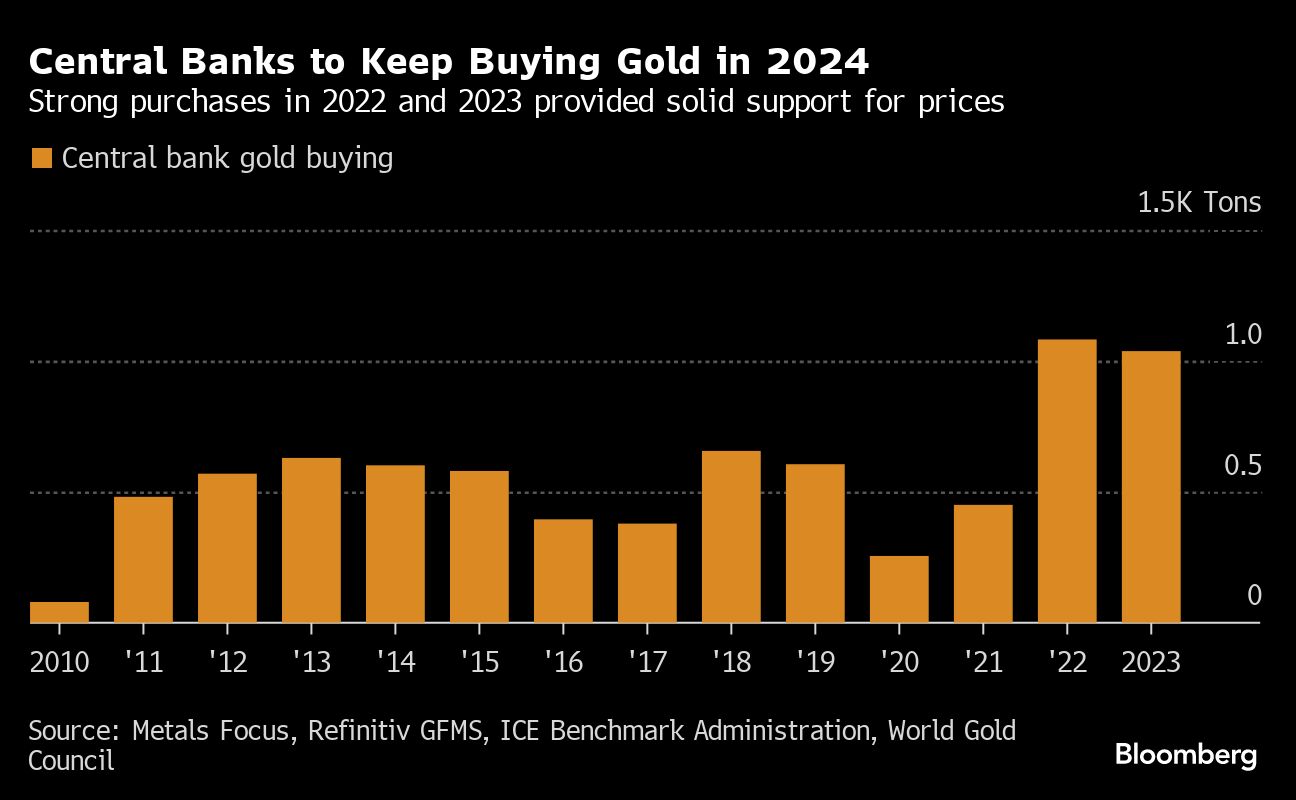

“The landscape is appropriate for emerging central banks to continue to be net buyers,” Joseph Cavatoni, chief market strategist at the WGC, said in an interview. The council sees a strong case for record buying by countries such as China and Poland, he said.

The comprehensive demand figure includes bullion for investment, jewelry, coins, central-bank buying, exchange-traded funds and OTC activity. In that latter market, participants including sovereign funds, high net-worth individuals, and hedge funds invest in gold bars, Cavatoni said.

The precious metal rallied 13% last year, touching a record in early December, on the back of economic and political uncertainty, geopolitical tensions, and expectations that the Fed is poised to start easing policy after an aggressive hiking campaign to tame inflation. Investors typically want to own gold in a rate-cutting cycle as it benefits from lower Treasury yields and a weaker dollar.

Insights into the Fed’s stance are due within hours, with the bank’s policymakers set to announce the result of their first meeting this year. While no change in borrowing costs is expected, their statement, as well as Chair Jerome Powell’s media conference, will yield clues about the outlook.

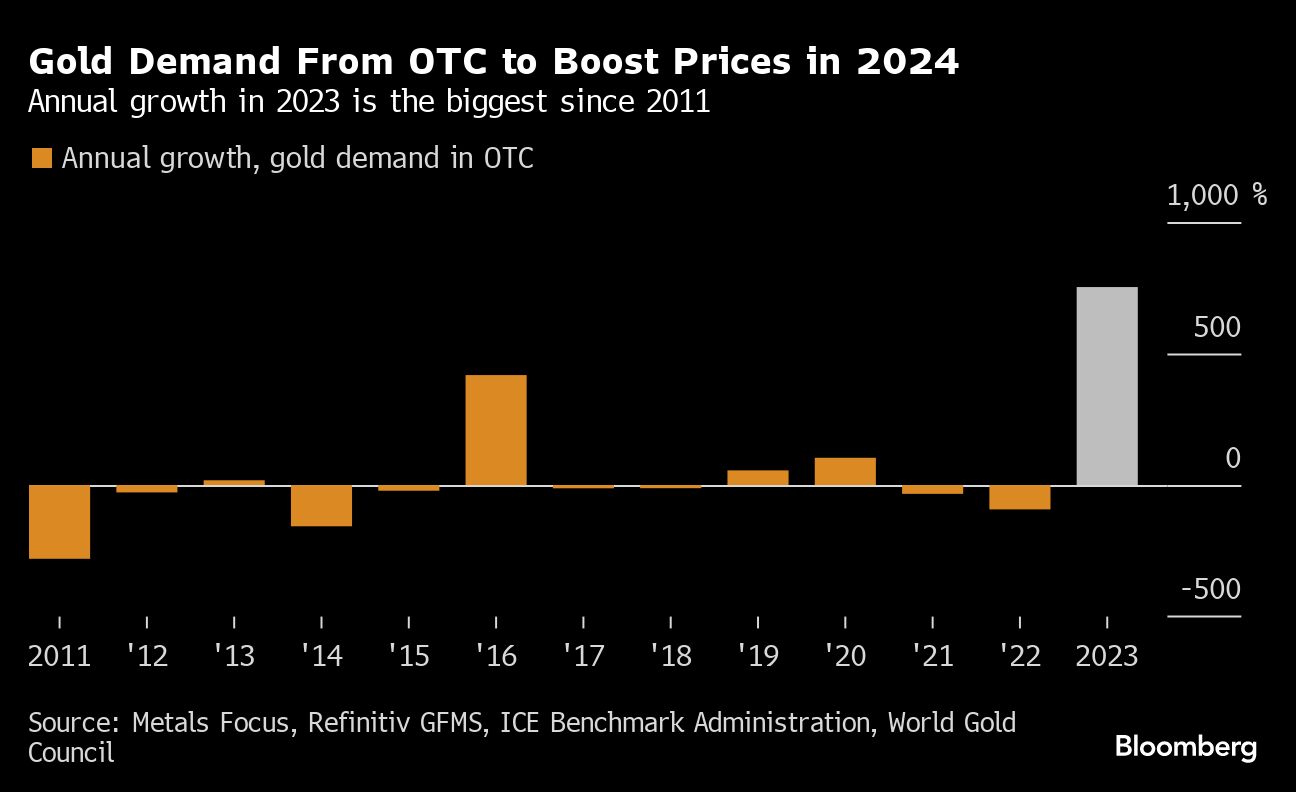

Annual demand growth in the OTC market hit 753% last year, the most since at least 2011, WGC data showed. Investors are expected to continue accumulating gold at an accelerated pace this year, largely driven by the Federal Reserve’s expected pivot toward easing, according to Cavatoni.

Central-bank buying maintained a breakneck pace, with annual net purchases of 1,037 tons last year, just 45 tons shy of the record set in 2022, the WGC said in the report. It expects central-bank buying to top 500 tons this year.

The expected OTC spree, as well as central-bank buying, will provide a key counterweight to softness elsewhere, especially exchange-traded funds. That provides strong upside for prices, with a case for $2,200 an ounce or more, according to Cavatoni.

Spot gold — which last traded near $2,036 an ounce — peaked at $2,135.39 in December.

Jewelery demand may struggle this year as economic slowdowns and high prices start to bite, according to the WGC, which put consumption from this sector at 2,093 tons in 2023.

One bright spot may be India, the second-biggest consumer, with demand from the Asian nation expected to rebound to between 800 and 900 tons in the next two years after sliding to 748 tons in 2023.

The rebound is supported by increased incomes as the economy grows, said P.R. Somasundaram, regional chief executive officer at the council in India. Sales were steady in the past few years despite a massive jump in prices, he said.

In China, demand for gold jewelery is likely to remain stable, as consumers have sought to preserve value in the safe-haven asset against a weakening currency and an increasingly uncertain economic outlook. Still, the WGC expects ... "

https://www.mining.com/web/gold-demand- ... g-wgc-says