Why junior gold stocks could be gearing up for a glittering performance

Frank Holmes - U.S. Global Investors | September 22, 2023 | 5:15 pm Intelligence Markets Gold

"Early in the week I was in beautiful Colorado Springs attending the 35th annual Denver Gold Forum, where sentiment for all things gold was cautiously optimistic.

First, however, I want to share with you some discussions and concerns I overheard at the conference about the ongoing migrant crisis, not just at the U.S.-Mexico border but also in Italy and Europe. The mainstream media has finally started reporting on the situation, with the story appearing on page one of today’s Wall Street Journal.

Some people pointed out that they believe the crisis is not accidental, but orchestrated with the purpose of overextending local law enforcement and infrastructure and destabilizing the U.S. and Europe. If you watch videos of migrants arriving on the shores of Italy’s Lampedusa Island, for instance, you’ll notice that they made the trip in nice, high-end boats that cost upwards of $100,000. There’s serious funding behind this activity, and many conferencegoers said they believed it could be Russian president Vladimir Putin.

I can’t say if this is true or not, but the issue was top of mind among many of the people I spoke with.

Many of the speakers and attendees were bullish on the physical metal, pointing to gold’s resilience in the face of a very strong U.S. dollar and multiyear-high yields. When the Federal Reserve begins to lower rates and the value of the greenback cools relative to other currencies, I believe it will really be dollar-denominated gold’s time to shine, as it is right now in many countries such as Argentina, Japan, China, South Africa and more.

Investment in gold and gold mining stocks is another thing altogether. Total known holdings in physical gold ETFs currently stand at just under 89 million ounces, down from around 106 million ounces in April 2023, according to Bloomberg data.

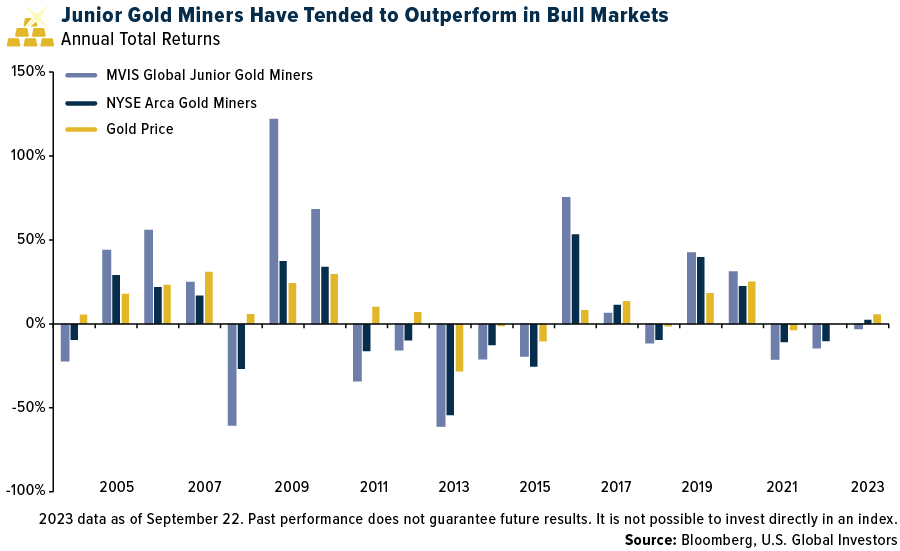

Investor appetite for junior gold miners—those that produce less than 1 million ounces a year, if at all—has also been muted, despite small-cap explorers and producers having greater operating leverage and earnings upside to rising gold prices. In the chart below, you can see that the MVIS Junior Gold Miners Index outperformed the seniors—sometimes greatly—when gold prices were ripping, though juniors also had lower lows when the yellow metal was under pressure.

Junior gold miners have tended to outperform in Bull Markets

Should shares of junior miners end 2023 in negative territory, it would mark the third straight year of lackluster returns and the longest losing streak since the gold bear market that persisted from 2011 through 2015. It’s important to note the high-risk, high-reward nature of the junior gold space. For the 20-year period, the juniors have averaged about 9% per year compared to around 4.1% for the seniors.

Many speakers at the conference were focused specifically on Canadian juniors, but challenges persist in other markets as well. The Johannesburg Stock Exchange (JSE), historically rooted in mining, is increasingly losing junior mining and exploration companies. Of the 39 mining companies listed on the JSE, only six were genuine precious metal exploration or development firms, starkly contrasting with over 2,000 listings on Canadian stock exchanges.

With the Fed potentially near the end of its rate-hiking cycle and the dollar poised to correct, now could be an opportune time to start considering an allocation to junior gold explorers and producers in anticipation of higher gold prices.

But how do you go about doing it?

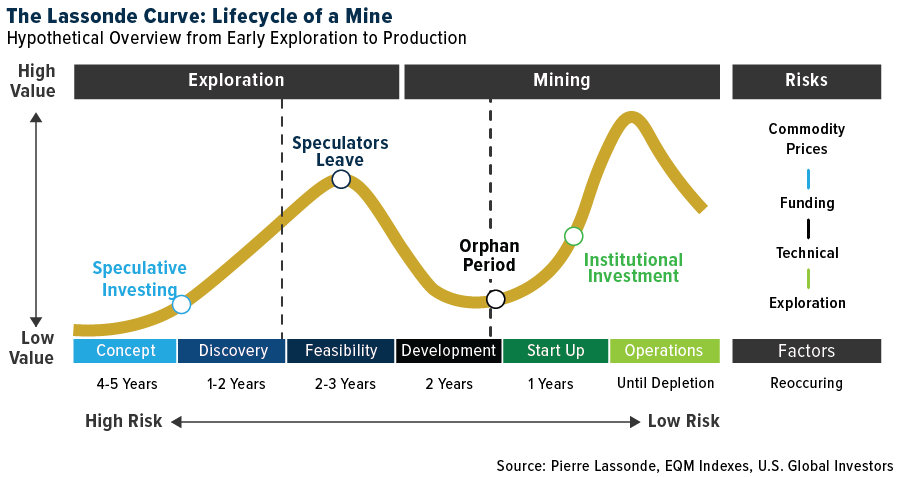

Anticipate before you participate: the lifecycle of a mine

Investing in junior mining companies requires a deep understanding of the mine’s lifecycle. For that, we’ll turn to the Lassonde Curve. Named for my longtime friend and mentor, Pierre Lassonde, cofounder of Franco-Nevada, this metric illustrates seven distinct stages from early exploration to depletion, each offering unique risks and opportunities.

The Lassonde Curve: Lifecycle of a mine

Initially, in the “Concept” stage, geologists use geochemical and sampling techniques to locate potential gold deposits and analyze drill cores for mineral content, which, if found in sufficient amounts, might hint at a viable mineral deposit. The second stage, “Discovery,” rewards early speculators, showing the potential for mining based on a significant presence of gold. This stage gives way to the “Feasibility” phase, where studies evaluate the deposit’s profitability prospects. Speculative investment peaks here due to lingering uncertainties.

The subsequent “Development” phase is a pivotal point where many mineral deposits can falter, with companies required to secure funding, develop a production blueprint and assemble an operational team. Successfully navigating this stage leads to the “Startup” stage, where the company starts processing ore, resulting in revenue generation. The concluding “Operations” stage, when gold is actively being dug out of the ground, has historically attracted even more institutional investors.

Are microcaps poised for a comeback post rate cuts?

I believe the allure of small-cap gold mining stocks extends to microcap stocks in general.

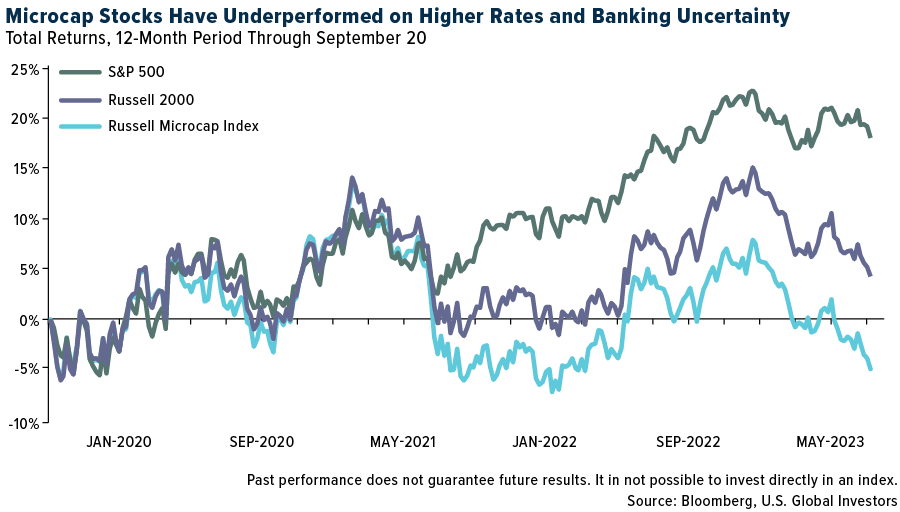

Microcap stocks in general, which constitute less than 2% of the U.S. stock market’s total investable market cap, can be an attractive part of a portfolio due to their low correlation with larger market caps and potential as a liquid and cost-effective substitute for private equity. However, they come with challenges like increased volatility, limited liquidity and scant options for investors seeking exposure.

The Russell Microcap Index, with over 1,500 holdings and an average market cap of $660 million as of August, serves as a common microcap reference. Stocks in this group have underperformed this year primarily because of rising borrowing costs and uncertainty in the banked sector. Large companies raise most of their funds from capital markets by issuing bonds, after all, while smaller companies largely rely on lending from banks.

Microcap stocks have underperformed on higher rates and banking uncertainty

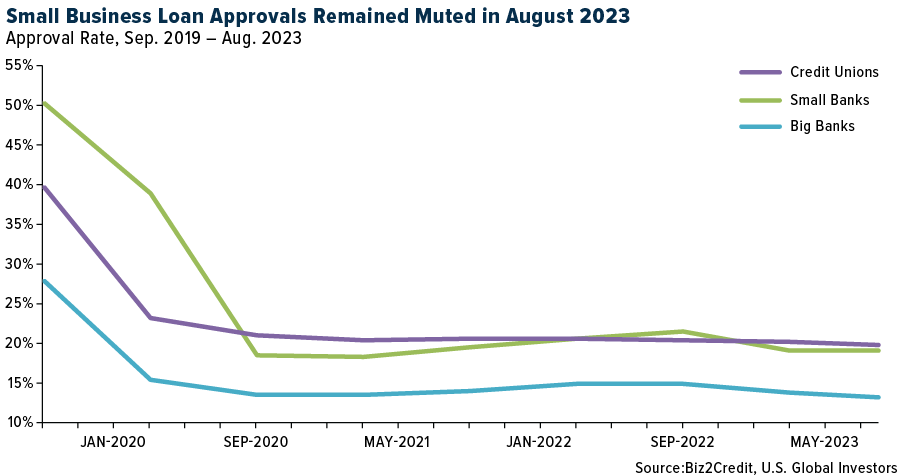

Indeed, small U.S. businesses are finding it increasingly difficult to access the necessary capital to operate and expand right now, according to a recent survey by Goldman Sachs. Of those who applied for a business loan in the past year, 70% of businesses reported difficulties in obtaining capital, up from 61% in April 2023.

In August, the Biz2Credit Small Business Lending Index revealed that big banks ($10 billion+ in assets) experienced a decline in small business loan approval percentages, dropping to 13.2% from 13.3% in July—a near two percent decrease from 15.1% in August 2022. This continued a trend of declining approvals by big banks since June 2022.

In contrast, small banks, which often process government-backed Small Business Administration (SBA) loans, saw a slight rise in approval percentages from 18.9% in July to 19.1% in August, though this is significantly lower than pre-pandemic figures.

Meanwhile, credit unions’ approval rates hit an all-time low in August at 19.8%, slightly down from July’s 19.9%.

Small business loan approvals remained muted in August 2023

But as is the case for gold stocks, we may see ... "

https://www.mining.com/web/why-junior-g ... erformance