GRAPHIC: Robust equities erode gold’s safe-haven allure as ETF holdings fall

Reuters | August 21, 2023 | 10:02 am Intelligence Markets Gold

Stock image

"Receding fears of a US slowdown, surging bond yields and the robust performance of equities have gradually eroded the appeal of exchange-traded funds (ETF) backed by traditional safe-haven gold this year, despite sticky inflation.

Overall holdings in over 100 gold ETFs tracked by the World Gold Council (WGC) fell to 3,348 metric tons as of Aug. 18, at their lowest level since 3,330 tons in April 2020.

The biggest ETF, SPDR Gold Trust GLD, saw holdings dwindle to pre-pandemic levels.

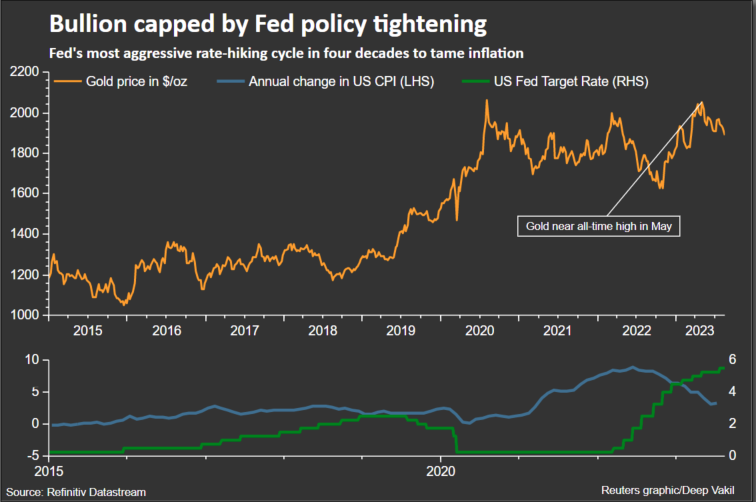

Investors typically buy gold during times of financial and economic uncertainty and rising inflation. This was seen in May when gold rallied to near-record highs during the US regional banking crisis.

Since then, prices have dropped roughly 9% to five-month lows around $1,890 per ounce.

“Gold has fallen into disfavour as a hedge against economic uncertainty for many institutional investors,” said Ross Norman, chief executive of Metals Daily.

Recent US economic data has created uncertainty about further rate hikes from the US Federal Reserve and raised some hope for a “soft landing” for the US economy.

“The economy is sound, especially in the US, and risks of a recession have already receded. Hence, there’s no imminent need to shift into gold at the moment,” said Carsten Menke, head of Next Generation Research, Julius Baer.

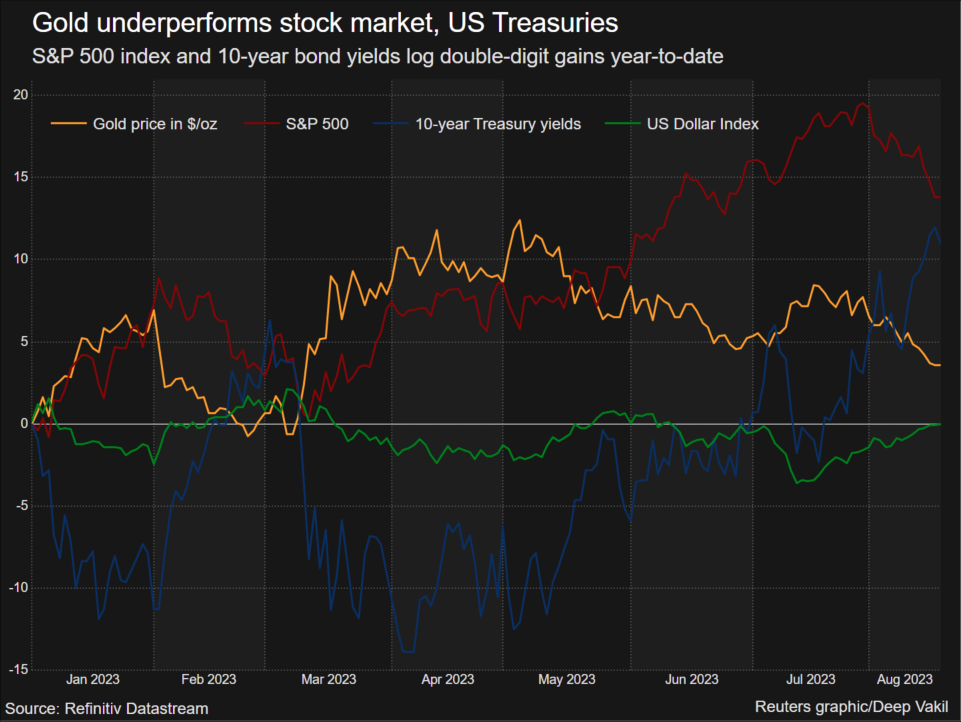

Equities have outperformed gold despite higher interest rates, while rival safe-haven Treasury bonds have attracted investors away from gold, which doesn’t earn any interest or dividends.

Gold has returned 3.5% so far this year, less than the 13.8% from the S&P 500 and the 11% from benchmark 10-year US bond yields.

However, “while some investors have come out of the ETF space, there’s still a positive view of gold as an asset diversifier,” said Philip Newman, managing director of Metals Focus.

Generally strong prices have also supported gold in value terms, Newman added, so “there hasn’t been the need to maintain those positions in ounces.”

Gold currently makes up around ... "

https://www.mining.com/web/graphic-robu ... dings-fall