Platinum price surges as speculators bet supply will run short

Reuters | May 2, 2023 | 2:08 pm Markets Africa Platinum

Stock image

"Platinum prices have shot up as speculators bet that power outages at South African mines and rising demand from auto makers and the hydrogen industry will create supply shortages.

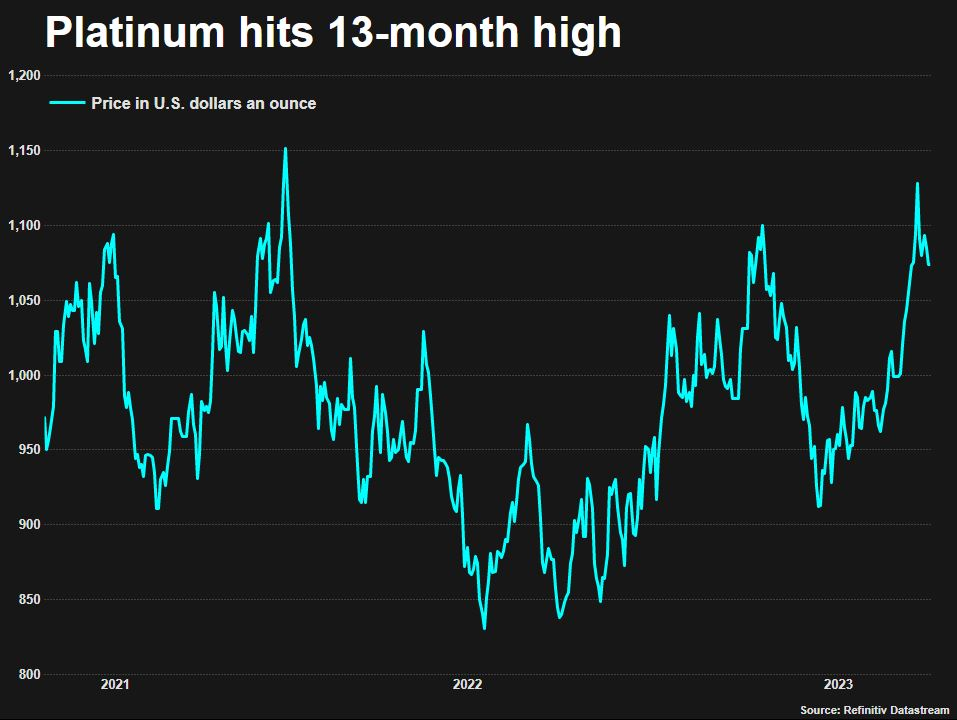

Platinum is used to neutralize harmful engine emissions, as well as in other industries and jewellery. Prices leaped from just above $900 an ounce in late February to $1,132.17 on April 21 — the highest in more than a year — before easing to around $1,050 by Tuesday.

Charting platinum prices

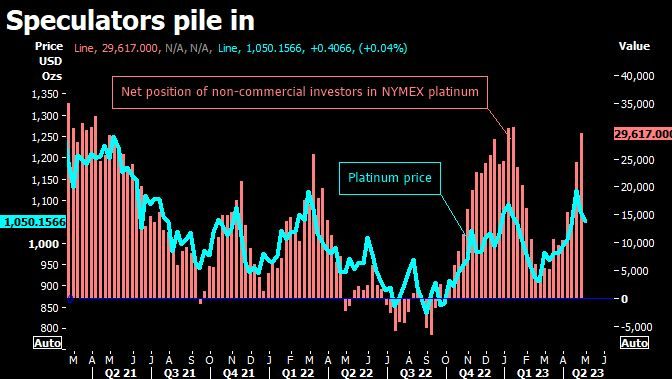

Speculative investors have expanded their net long position in NYMEX platinum futures to 1.5 million ounces from 145,000 ounces in late February, exchange data show.

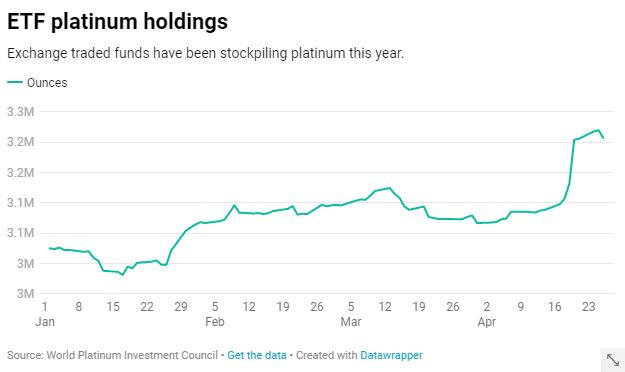

Exchange traded funds (ETFs) storing platinum for their shareholders meanwhile bought around 120,000 ounces in just a few days in late April, according to the World Platinum Investment Council (WPIC), which tracks funds.

Charting platinum prices and the net speculative position in NYMEX platinum

Exchange traded funds have increased their holdings of platinum

“We think this is the first year of serial deficits in the platinum market,” said Standard Chartered analyst Suki Cooper.

However, Cooper said prices could weaken in the short term before supply risks worsen later in the year.

South Africa produces 70-75% of mined platinum supply. Miners there have said rolling power cuts could cut their output by 5-15% this year, Cooper said, adding that Russian production may also disappoint.

“We’re now entering the winter period in South Africa and getting more frequent alerts on power outages,” she said. “The market is concerned.”

Demand from the auto industry — the biggest consumer of platinum — should rise by 8% this year as vehicle production increases, said StoneX analyst Rhona O’Connell.

O’Connell forecasts a 900,000 ounce deficit in the roughly 8 million ounce a year platinum market this year. The WPIC predicts a shortfall of around 500,000 ounces.

Investors also hope that large amounts of platinum will be used in the production and use of hydrogen.

But analysts at Macquarie said this could take years. “In our base case, the sector (across fuel cells and PEM electrolysers) would account for ... "

https://www.mining.com/web/platinum-pri ... -run-short