Rolex is a mere pretender to the Patek Philippe crown at watch auctions

By Simon de Burton - August 19, 2021

Rolex made such a splash in 2017 when a Paul Newman-owned Daytona sold for $17.5 million that the casual observer might think it has dominated the auction world’s top ranked sales ever since. Not so, observes Simon De Burton, who sees Patek Philippe firmly maintaining its reputation as the king of auction brands and a number of rising stars like Cartier, F. P. Journe and Philippe Dufour regularly grabbing the attention of expert collectors.

"Anyone who keeps a close eye on the salerooms will probably know that around a dozen vintage Rolex watches have broken the million dollar barrier during the past six years, with some prices soaring to hitherto unimagined heights — notably the ex-Paul Newman Cosmograph Daytonas sold in 2017 and 2020 for $17.75m and $5.4m respectively, the unique, white gold Reference 6265 ‘Unicorn’ sold for charity by super-collector John Goldberger in 2018 and the Reference 6062 one-off originally owned by Vietnamese emperor ‘Bao Dai’ that drew $5.06m in 2017.

But what might surprise those who have only been paying attention to Rolex auction prices since 2015 is the fact that, until a decade ago, no watch by the illustrious dial name had even entered into the magical realms of seven figures at auction.

That changed in the spring of 2011 when Christie’s drew $1.1m for a 1942 Reference 4113, one of a dozen examples known of the maker’s only split-seconds chronograph.

After that, it seemed, many really serious collectors stopped restricting their biggest bids to Patek Philippe and prices for rare Rolex models began to climb steadily, giving the impression that the long-standing one-horse race had become a two horse affair as watches by the mighty Crown regularly began to fetch high, six-figure sums.

Closer analysis, however, shows that Patek Philippe remains way ahead of its perceived saleroom rival and has more or less unshakably maintained its dominance.

The fact was ably demonstrated during this year’s spring and early summer auctions, firstly when the four most expensive lots sold at Phillips in Geneva — all Pateks — achieved a combined total of more than $16m, with the top lot, a Reference 2523 World Time with ultra-rare ‘Eurasia’ enamel dial, alone drawing a remarkable $7.8m.

Three weeks later, the house moved to Hong Kong where Patek Philippe again accounted for the four top lots with the star being a Reference 2499 at $1.9, while, elsewhere on the top ten list, there wasn’t a Rolex in sight.

A Rolex did come to the fore at Sotheby’s in Hong Kong, however, when a platinum Cosmograph Daytona Reference 16516 (Zenith movement) with a turquoise ‘Stella’ dial soared to a six-times estimate US$3.1m — a figure accountable for by the fact that the watch was very likely to be unique.

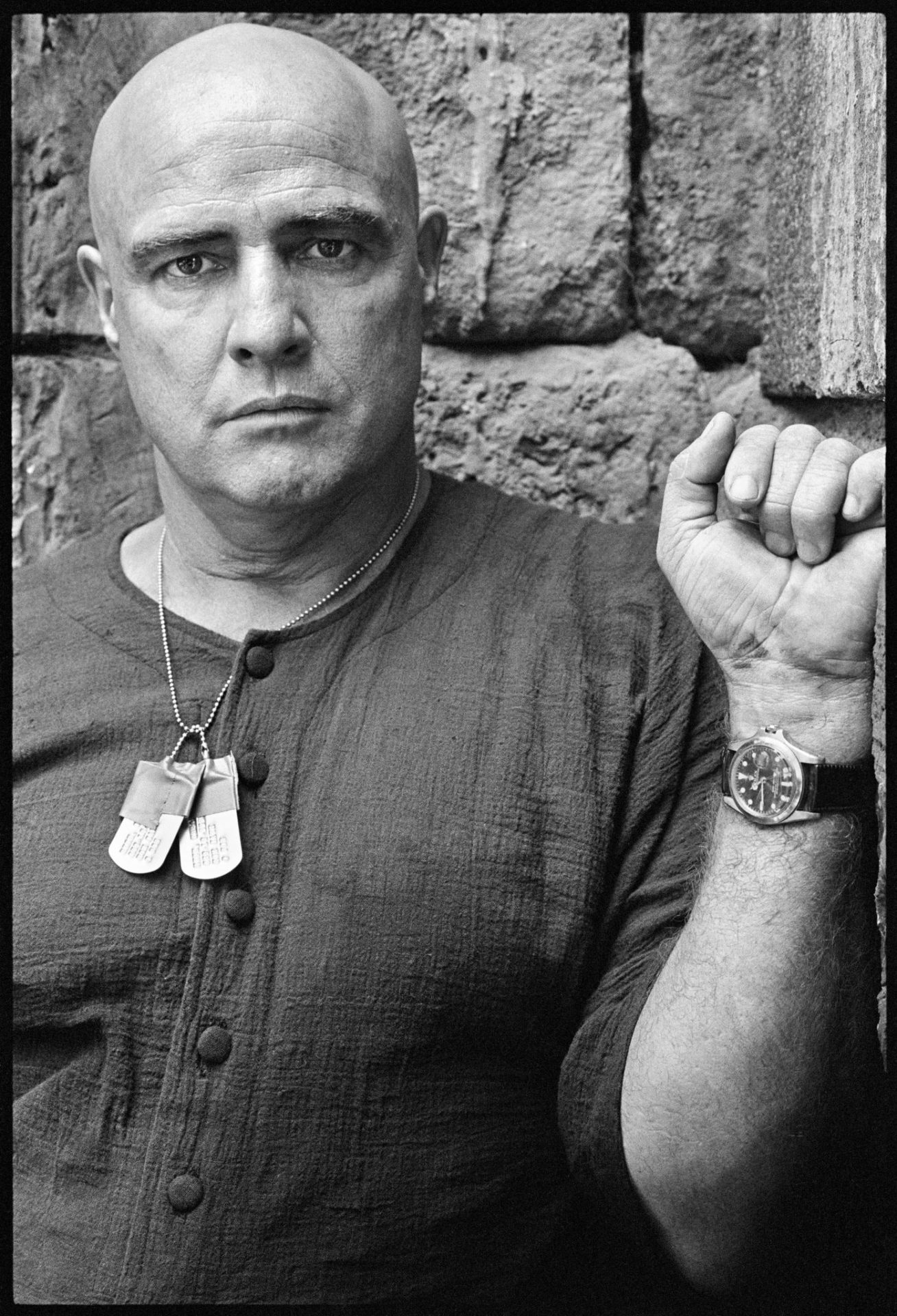

Although the price was undeniably impressive, it also served to reinforce the differences in collectability and values that exist between Rolex and Patek — essentially, that the former will usually only realise really big money if the watch in question is a rare or unique variant of the Daytona, or if it has exceptional celebrity provenance (think, for example, of the tatty ex-Marlon Brando GMT-Master sold in 2019 for $1.95m).

A tatty ex-Marlon Brando Rolex GMT-Master sold in 2019 for $1.95m

In contrast, there are a whole host of Patek models for which collectors are willing to pay huge sums and, save for a few exceptional situations (such as Henry Graves-owned pieces or Churchill ‘Victory’ watch sold in 2015 for an eight-times estimate £485,000) the value is far more often in the watch than in who has owned it.

But while Patek Philippe’s position of overall dominance looks set not only to remain unrivalled, but to strengthen, the long-standing Rolex/Patek ‘duopoly’ that has prevailed at upper end of the collector market is fast being challenged by the rising prices being achieved by other makes which, while always considered first division, have not previously been part of the two-club ‘premier league’.

One of the most notable of these is Cartier which, despite its blue-chip name, remarkable client list and glittering history, has failed to set the world of watch auctions alight … until now.

A rise in auction prices has long been seen as inevitable to those in the know, such as noted Cartier dealer Harry Fane who highlighted just why the ‘king of jewellers’ watches are so collectable when I interviewed him for the Financial Times last year.

Fane began studying vintage Cartier objects during the 1970s and, having dealt in them exclusively since 1983, has owned some of the rarest and most covetable pieces such as the Pebble, the Benoit, the 10-sided and the famous Crash — the 1960s design with a distorted case that’s said to have been based on the battered shape of a Baignoire Allonge recovered from a car accident.

“The watches made by Cartier London in the late ’60s and early ’70s have become very sought-after, causing values to leap,” Fane told me. “But the quantities made were tiny — probably about 12 examples of the original Crash in the 1960s and between nine and 12 when the model was briefly re-issued in the ’80s”.

And it’s the models made in minuscule numbers that, suddenly, are hitting the big time at auction.

In recent weeks, for example, an unprecedented two examples of the Pebble have crossed the block at separate auctions, each time causing a bidding frenzy among collectors.

Cartier’s Pebble with turtle lugs

The first, sold at Phillips Geneva in May, fetched a quadruple estimate £321,000, shortly after which Bonhams London sold an especially scarce version with so-called ‘turtle’ strap lugs for £225,250.

The only other identical example is in Cartier’s own collection, and a mere six ‘Pebbles’ in total are believed to have survived.

In addition to Cartier’s arrival in the saleroom limelight, leading independent dial names are also edging their way into the rarefied realms of vintage Patek Philippe money as savvy collectors cotton-on to the rarity, quality and historical importance of certain makers/ models, as well as the fact that the originality and provenance of a modern watch is far easier to confirm than it is with pieces by traditional makers that could be anything up to a century old.

As a result, early Roger Dubuis models (pre the Richemont take-over) together with those by makers such as Kari Voutailainen, Philippe Dufour, Roger Smith and F.P. Journe are now drawing really serious money.

One of the three ‘Onely’ Series One watches Mr Smith made for society jeweller Theo Fennell, for example, soared to a near ten-times estimate achieving CHF 541,800 at Phillips in Geneva.

Bonhams sold a ‘Millennium’ by George Daniels for £519,000 to set a world auction record for an English-made wrist watch.

In June, Bonhams sold a ‘Millennium’ by George Daniels (made in close collaboration with Smith) for £519,000 to set a world auction record for an English-made wrist watch.

And, WATCHPRO quietly predicts, we’ll be seeing some staggering prices for F.P Journe in November when the only known set of all five of the maker’s ‘Souscrition’ watches are offered by Phillips Geneva.

A full set of five F.P Journe ‘Souscrition’ watches are offered by Phillips Geneva in November.

The watches, each of which is ‘number one’ in its series, comprise a Tourbillon ... "

https://www.watchpro.com/rolex-is-a-mer ... -auctions/