25-year chart shows mining stocks chronically undervalued to gold price

MINING.COM Staff Writer | September 21, 2021 | 6:07 pm News Gold

Gold price and gold stocks diverge. Stock image.

"While copper and iron ore mining stocks were hammered as prices for the steelmaking ingredient and bellwether metal slide, gold attracted investors looking for safe havens this week.

The gold price is up a tidy $30 an ounce since Friday’s close, touching $1,782 on Tuesday and back to its Q3 opening levels. In contrast to bullion’s relative buoyancy, gold mining stocks remain in a slump. Newmont investors are nursing 14% losses quarter to date, Barrick is down double digits and AngloGold Ashanti is edging closer to 20% down.

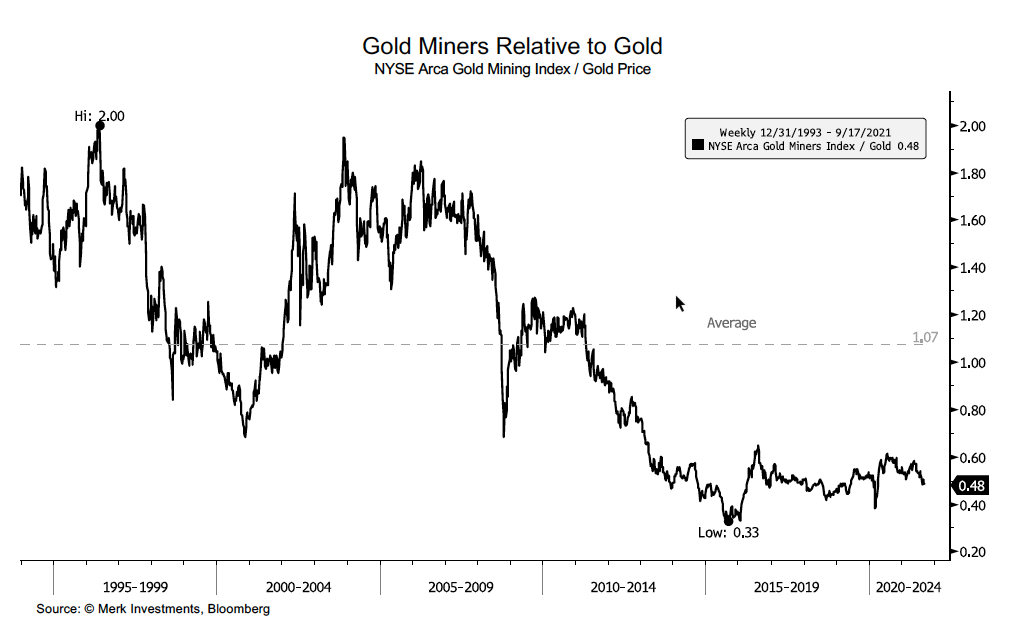

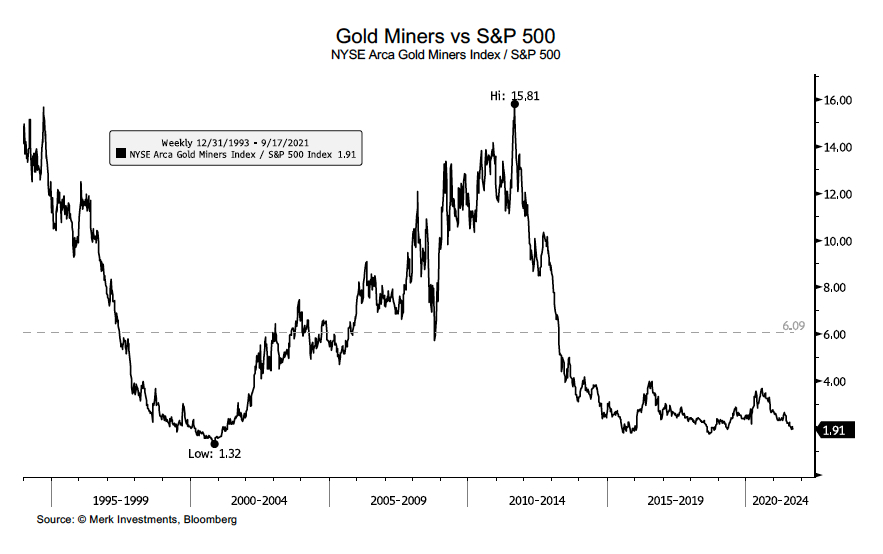

A new chartbook released by Merk Investments, an investment advisor, and ASA Gold and Precious Metals (NYSE:ASA), a closed-end investment fund established in 1958, includes two long-term charts that show gold mining stocks underperforming the price of gold is hardly a new phenomenon.

The current ratio between the metal and gold stocks as represented by the NYSE Arca Gold Mining Index, is not far off historic lows struck in 2015 and gold stocks have been underperforming gold for a decade.

If the price of gold stays stable at today’s levels, gold stock valuations would have to more than double to bring it in line with the historical average since the early 1990s.

Balance would also be restored should the gold price halve of course, but there is no scenario where bullion trading in triple digits does not bring carnage to the equities.

At the same time, despite robust gold prices (and record highs along the way), gold mining stocks have also been deeply discounted when compared to US stocks in the form of the S&P 500.

Download the chartbook here."

https://www.mining.com/25-year-chart-sh ... gold-price