Nevada’s Carlin Trend

By Admin -

November 12, 2020

By Steve Voynick

"Events of the past few decades have rewritten the history of American gold mining. California billed as the “Golden State,” no longer leads all states in cumulative gold production. Taking its place is Nevada, which, ironically, is known as the “Silver State.”

Since 1983, Nevada has hosted America’s greatest gold-mining boom ever. During those 35 years, the state has produced 200 million troy ounces (6,250 metric tons) of gold with a cumulative, year-mined value of roughly $140 billion. To put these figures into perspective, recall that in 1852, the California gold rush’s peak year, miners recovered 2.5 million troy ounces of gold. This year, Nevada will produce more than five million troy ounces—and has done so for the past 28 consecutive years.

Nevada, which accounts for 80 percent of the United States’ current annual gold output, has produced nearly half of all the gold ever mined in the nation. If Nevada were a country, it would now rank fourth in annual world gold production. And most of Nevada’s gold has come—and is still coming—from a five-mile-wide, 40-mile-long strip of land called the Carlin Trend that is the world’s third-richest gold-mining district of all time.

This 1.5-inch specimen of native gold is from the Round Mountain Mine, one of the few Nevada mines where native gold is found today.

Nevada’s gold mining adventure began in 1849, with a series of minor placer strikes that went unnoticed in the shadow of the California gold rush. But in 1859, small-scale placer-gold mining led to the discovery of the Comstock Lode, when sluice boxes became clogged with heavy, black sands that were identified as oxidized silver minerals. As the nation’s first major source of silver, the Comstock Lode gave Nevada both statehood and its “Silver State” nickname.

By the time the Comstock’s best ores were gone in 1875, it had yielded 20 million troy ounces of silver and 700,000 troy ounces of gold. At that point, Nevada’s mining industry fell flat until 1900, when rich gold strikes revived it at Goldfield and Tonopah. By 1980, Nevada had turned out 20 million troy ounces of gold—certainly respectable, but not much compared to California’s 110 million troy ounces.

Elko’s Emergence In Gold History

Nevada’s entry into the big leagues of gold mining began in spring 1961, near the little town of Carlin 23 miles west of Elko. For months, two geologists had left their motel at daybreak, heading out in their pickup into the sage-covered hills of the Tuscarora Mountains. Folks in Carlin all knew the geologists were searching for gold, and that made the old-timers smile because they had futilely searched those same hills for gold themselves.

The geologists, John Livermore and J. Alan Coope were looking for a specific type of gold—invisible, micron-sized particles. Along with that goal, most importantly, an unproven theory that concentrations of microscopic gold could occur in sedimentary formations. Livermore and Coope studied rock formations and collected thousands of samples. But all the assays only reported grades far too low to be mined.

In June, the old-timers in Carlin were surprised when the two geologists staked 17 claims for the Carlin Gold Mining Company, a “paper” corporation consisting only of the two geologists, their prospecting equipment, and a pickup truck. The geologists then bulldozed three trenches and collected more samples. Assay reports from the first two trenches were disappointing, but those from the third trench showed an encouraging 0.22 troy ounces of gold per ton. That was much higher than all previous samples, but still very low-grade when measured against traditional mining standards.

In their next step, Livermore and Coope ordered in a three-month-long core-drilling program. By December, the cores had revealed exactly what they had found—a very low-grade, but massive, ore body. They estimated the size of the ore body at 11 million tonnes, and its average grade at nearly 0.3 troy ounces of gold per ton. The microscopic gold particles, which were included or dissolved in pyrite, were disseminated throughout a massive, 80-foot-thick, shallow formation of sedimentary rock.

The deposit contained about three million troy ounces of gold or nearly 100 tonnes (one tonne = one metric ton = 31,103 troy ounces) worth, at the prevailing gold price of $35 per troy ounce, roughly $100 million. This discovery was merely the tip of a golden iceberg. In just the next few years, other geologists would make a dozen strikes, all within a strip of land now known as the Carlin Trend. These strikes were the payoff of decades of research. Assayers had first recognized the existence of microscopic gold particles in the 1890s when fire assays revealed invisible gold values.

Then, in the 1930s, geologists discovered random trace occurrences of disseminated microscopic gold in sedimentary rock. The sedimentary occurrences were surprising because, at the time, lode gold had been mined almost exclusively from vein-type deposits in igneous rock. In 1937, U.S. Bureau of Mines researcher W. O. Vanderburg noted that Nevada’s microscopic-gold mineralization was “impossible to distinguish between ore and waste rock except by assay . . . and that it is impossible to obtain a single color by panning.” Vanderburg inferred the types of sedimentary formations that might contain disseminated microscopic gold but warned that they would be very difficult to identify.

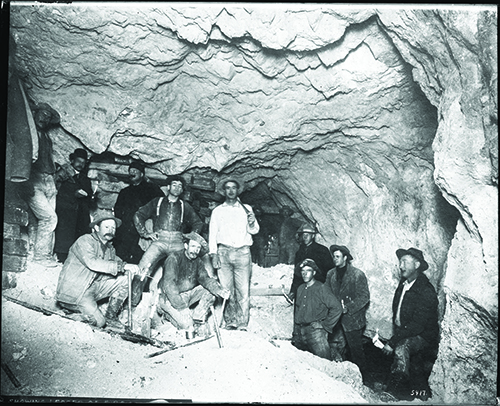

An underground mine crew at Goldfield in 1904. Wikimedia Commons.

In the 1950s, United States Geological Survey geologist Ralph J. Roberts described the

Roberts Mountain Thrust, a geological anomaly north of Carlin where older rocks were thrust over younger rocks. He then correlated known mineral deposits with geologic “windows”—areas where older rocks had eroded to expose lower, younger, mineralized formations. And it was certainly no coincidence that all known mineral deposits were located at geologic windows. When Roberts published his findings in 1960, American gold mining had hit rock bottom. Ore grades were lower than ever, mining costs continued to escalate, and the price of gold remained locked at $35 per troy ounce. American gold production had sagged to just 750,000 troy ounces per year, most coming as a by-product of silver and base-metal mining.

The intensive geological investigation that followed the 1961 discovery soon determined the origin of the Carlin Trend’s gold. Some 50 million years ago, tectonic stresses and related faulting and folding had created the contorted geology of Nevada’s basin-and-range country. Near the present site of Carlin, stresses had fractured sections of older Ordovician rock, thrusting them laterally over younger Devonian rock. Deep, vertical fractures in the porous Devonian rock enabled gold-rich, siliceous solutions to rise until they “pooled” beneath the overthrust, impermeable Ordovician layer. High temperature and pressure had prevented these gold-rich solutions from crystallizing. The solutions, which were barred from farther upward vertical movement, migrated laterally through the porous Devonian rock, silicifying the sediments and precipitating gold in disseminated, microscopic particles.

Carlin Gold Discovery Changes Trajectory

Eventually, sections of the overlying Ordovician rock eroded to create geologic “windows” that exposed the underlying, gold-bearing Devonian sediments. Recognizing these “windows” had been the key to discovering the gold of the Carlin Trend.

The timing of the Carlin gold discovery was propitious, both technologically and economically. Although miners had treated gold ores with cyanide since the 1890s, they could not efficiently recover the gold from the solution. But in the late 1950s, researchers from the United States Bureau of Mines developed the carbon-in-pulp (CIP) process, which used activated charcoal to recover dissolved gold from cyanide solutions quickly by adsorption.

With the inexpensive CIP process, cyanidation finally achieved its full potential in extracting gold from very low-grade ores. But Nevada’s looming gold-mining boom still needed an economic boost. In the 1960s, it had already become clear that the United States and other governments could not hold the line on $35 gold indefinitely. Gold would certainly become a high-priced, free-market commodity; the only question was when.

The Carlin Gold Mining Company, a subsidiary of the Newmont Gold Corporation, didn’t wait for the coming era of free-market gold. In 1963, it opened the Carlin Mine, the world’s first open-pit, primary gold mine. It mined vast tonnages of low-grade ore that were crushed, ground, and treated by cyanidation. The CIP process recovered the gold, which was melted in electric furnaces and poured into bars. The metal actually poured was doré, a mix of roughly 90 percent gold and 10 percent silver.

In its first year, the Carlin Mine produced 128,000 troy ounces of gold. More importantly, it was the model for dozens of future mines.

In 1974, gold became a free-market commodity. By the early 1980s, its price had peaked above $800 per troy ounce, then settled into the $300-$400 range. With everything now in place—large deposits of ore ready to be mined, high gold prices, inexpensive mining and recovery methods, and a state eager to support a mining industry—Nevada’s gold boom was underway. Until 1983, Nevada produced only about 200,000 troy ounces per year, mostly from the Carlin Mine. But by 1985, a dozen new mines had come on line to boost Nevada’s annual gold production above one million troy ounces.

The technological know-how in mineral exploration and mine development gained in the Carlin Trend was quickly applied to other Nevada areas of similar geology. With big, new mines opening almost every year, Nevada’s gold production had topped five million troy ounces by 1990. But the boom was just getting started. Production increased every year until it topped nine million troy ounces in 1998. It then declined slowly over the next decade to just over five million troy ounces and has since held steady. For the last 28 consecutive years, Nevada’s annual gold production has exceeded five million troy ounces.

Gold’s Modern Impact

This typical piece of Carlin-type ore is an altered, contorted mudstone; it is very low in grade and contains no visible gold.

In 2002, the Carlin Trend produced its 50-millionth troy ounce of gold. In celebration, the Carlin Trend mines minted a commemorative, one-troy-ounce gold coin that was presented to Nevada’s governor, who passed it on to the W. M. Keck Museum of the Mackay School of Mines on the University of Nevada-Reno campus.

Today, Nevada produces about 5.7 million troy ounces of gold each year, or 80 percent of U.S. production. The state’s gold-mining industry now has 27 active mines that provide 15,000 mining jobs with an average annual income of $80,000, along with another 65,000 jobs supplying goods and services to the mines. Most mines are located in the Carlin Trend; others are in the Getchell Trend and Battle Mountain-Eureka trends and the Alligator Ridge and Independence mine groups. Nevada’s best ores now grade only about 0.2 troy ounces of gold per ton; most grades are considerably lower. Some mines profitably exploit ores grading only 0.06 troy ounces of gold per ton. Carlin-type ores, which consist of disseminated gold in sedimentary rock, are classified as oxide, sulfide, or carbonaceous, and each must be processed differently. High-grade oxide ores are passed through cyanide-leaching circuits; low-grade oxide ores are dumped into huge pads for large-scale, heap-leach cyanidation.

In sulfide and carbonaceous ores, sulfur or carbon encapsulate the tiny gold particles to reduce cyanidation efficiency greatly. These so-called “refractory” (literally “stubborn”) ores must be oxidized before cyanidation. Carbonaceous ores are roasted to burn off the carbon; high-grade sulfide ores are ground and oxidized in autoclaves with a combination of heat, oxygen, and pressure.

Unlike igneous-rock-hosted, vein-type metal deposits, Carlin-type gold ores provide few mineral specimens. An exception is the Carlin Trend’s Meikle Mine, which is well-known for complex clusters of transparent golden barite with colors ranging from light straw to amber.

Unlike most Carlin Trend mines, the Meikle is an underground operation where miners have ready access to ores for specimen collecting. Nevada’s top source of native-gold specimens is the Round Mountain Mine in south-central Nevada. Round Mountain opened as an underground mine in 1906, exploiting high-grade, vein-type ores in volcanic environments. By the time the high-grade veins played out in 1966, the mine had produced 350,000 troy ounces of gold.

With large volumes of low-grade ores remaining, Round Mountain was converted to an open-pit operation in 1977. The mine’s cumulative production now tops 11 million troy ounces. An estimated three percent of its gold occurs in visible form, and isolated pockets still yield fine specimens of crystallized gold. Because collecting gold specimens interferes with production, most of the crystallized gold is unfortunately processed into doré. The Twin Creeks Mine and the now-closed Getchell Mine in northwestern Nevada’s Getchell Trend have provided fine, large clusters of orpiment and realgar.

Uncommon Gold Splatters Draw Interest

Several years ago, the Newmont Mining Corporation made Carlin Trend gold available to its employees in the form of “Gold Splatters™.” Made by slowly pouring molten gold into cold water where it solidifies into pieces, each “splatter” has a unique shape and weight varying from a few grams to about one troy ounce. These “splatters” were sold individually, each accompanied by a purity-and-weight statement.

An unusual and beautiful souvenir of the Carlin Trend, “splatters” consists of an 88.42-11.58 percent gold-silver doré representing the actual gold-silver ratio of the Carlin Trend ores from which the gold was extracted. The Newmont employees who bought “Gold Splatters” kept them as souvenirs or made them into pendants. “Splatters” are still available in regional jewelry shops and on-line at prices a bit higher than the bullion value of gold.

Nevada’s gold-mining boom, now into its 35th year, is longest in the nation’s history with no end yet in sight. The proven and probable ore reserves of the Carlin Trend are estimated at 100 million troy ounces of gold. Proven reserves refer to ore bodies drilled to confirm size and grade, and are ready to be mined. Probable reserves are ore bodies of geologically inferred sizes and grades but have not yet been drilled.

These Gold Splatters™, each weighing about ten grams, are made from gold from Newmont’s Carlin Trend mines. Steve Voynick

At the current annual rate of production, mining in the Carlin Trend will last about more

than 20 years. But that estimate is dependent upon several factors, the first being the price of gold. Higher gold prices would automatically reclassify much lower-grade mineralization as ore, thus increasing reserves and the district’s mining life. Continuing exploration may discover new deposits, especially relatively high-grade ores at ... "

https://www.rockngem.com/nevadas-carlin ... newsletter